Isle of Man Chamber of Commerce has requested an urgent meeting with the government to discuss its concerns about rising costs.

The Chamber, which represents businesses that employ 20,000 people or half of the island’s private sector workforce, has said rising fuel, freight and other costs have created a ‘perfect storm’ that means businesses are now under more financial pressure than at any other time during the pandemic.

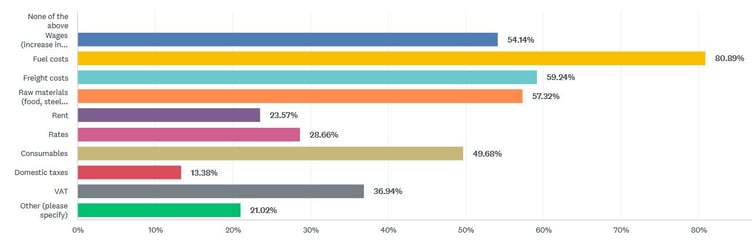

This opinion has been backed by the results of a recent Chamber of Commerce survey about the rising costs of doing business in the island.

A total of 157 local firms took part, with 35% saying they have seen major reductions in their revenues compared to 2019.

Soaring fuel costs are the most important factor, according to the survey, with 80% citing it as having the biggest impact, followed by the cost of freight, raw materials and wages.

Chamber chief executive Rebecca George said: ‘Businesses, especially small businesses that are right at the heart of our community, need help from government to weather this storm.

‘Our research has shown that businesses are drowning in a rising tide of costs with the latest survey results revealing that many are now also under extreme pressure from spiralling energy and freight costs, as well as increased wages.

‘The majority are having to increase prices, and many are also considering scaling back services to cut costs, or thinking about making redundancies.

‘All of this has a domino effect on other firms in the supply chain, and the economy. It’s also important to consider the human cost in terms of health and wellbeing.

‘Customers, suppliers and everyone else who relies on businesses that play such an important role in the local community are being affected too – so this is not just a business issue.’

The Chamber has since set out a plan to help businesses in the meantime. Its plan includes targeted support for the food supply chain, hospitality and small retail firms, to address workforce shortage by calling for the introduction of a 12 month worker’s visa and schemes to encourage economically active people into the workplace, the removal of the second job tax, the introduction of a freight charge subsidy for Manx retail and and hospitality businesses, and the extension of the 12.5% VAT rate for hospitality.

.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

-with-friend.jpeg?width=209&height=140&crop=209:145,smart&quality=75)

Comments

This article has no comments yet. Be the first to leave a comment.