City of London Police announced in February this year that it was investigating the family-run Seventy Ninth Group in connection with allegations of suspected widespread fraud.

The Southport-based group was placed in administration in April.

It denies any wrongdoing.

Around 3,700 investors, including dozens who banked in the Isle of Man, could potentially face significant financial losses following the company’s collapse.

Two Isle of Man subsidiaries, Seventy Ninth Air (IoM) Ltd and Seventy Ninth Air Two Ltd, have presented a petition for the winding up of the companies.

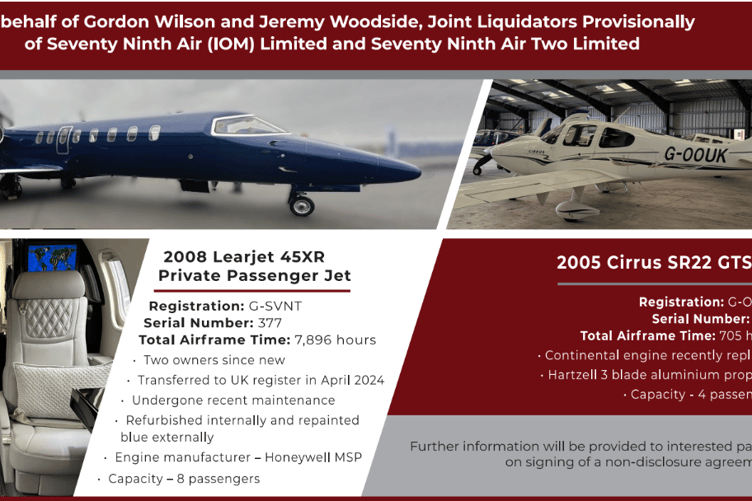

Gordon Wilson of FRP Advisory (Isle of Man) and Jeremy Woodside of administrators Quantuma were appointed provisional liquidators by court order on October 29.

The Learjet, registration G-SVNT, has seats for eight passengers, 7,896 flight hours and has had two owners since new.

It has undergone recent maintenance, refurbished internally and repainted blue externally.

The other aircraft has capacity for four passengers and has 705 flight hours.

A case management hearing in relation to the winding up petition was heard in the high court last week.

In an update to investors, the joint administrators say their findings to date indicate the 79th Group investment scheme was ‘likely operated as a Ponzi scheme’.

Worldwide freezing orders and injunctions against the directors and their connected parties were granted by the High Court in London on October 29.

It is estimated that more than £200m is owed to investors.

Seventy Ninth Group offered loan notes - also known as mini bonds - to investors with the promise of a high interest return over a fixed period.

Investors were offered the opportunity to invest with fixed returns between 12% for a minimum £10,000 investment and 15% for a minimum £25,000 investment.

Four people have been arrested and released on police bail while inquiries continue.

Seventy Ninth Air (IoM) Ltd and Seventy Ninth Air Two Ltd were both registered in the Isle of Man in January last year.

In their winding up petition, the directors state that the companies are unable to pay their debts.

They state: ‘The key assets of the companies are two aircraft originally financed through funding from other companies within common ownership in England and Wales. This funding took the form of loans.

‘One of the English companies has been placed into administration, and the administrators have made claims against the companies under the loan documentation.

‘Whilst there is a dispute of fact over the level of indebtedness and the manner in which such indebtedness should be pursued, it is unlikely the companies will have funds available to discharge this indebtedness.’

The directors say the companies are unable to access funding for the continued operation and maintenance of the aircraft - and money is owned to various services providers as a result.

.png?trim=0,0,0,0&width=752&height=501&crop=752:501)